Feb 6, 2013

In our Speed episode, we learn just how outdated our idea of the stock market is.

First of all, (perhaps we were naïve?) those sweaty dudes you usually think of when you hear the words "Wall Street" -- ya know, the ones who shout "SELL!" and "BUY!", those guys -- are pretty much history. These days, the markets are run by super computers who trade tens of thousands of stocks in mere milliseconds, all without the aid of any sluggish human beings. So with the help of our friend David Kestenbaum from Planet Money, we set out to try to wrap our heads around the crazy-fast-paced-world of today's market and its amazing-slash-notorious high frequency trading.

While researching this topic, I kept thinking:

What do these high frequency trades look like?

And the answer is...strangely beautiful.

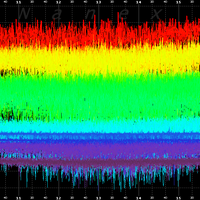

Take a look at this:

Animation from a few seconds on 7 November 2012; credit: Nanex

This mesmerizing animation is from Nanex, a research group headed by Eric Hunsader, who we spoke to for our Million Dollar Microsecond segment. Nanex tracks every single market transaction. All of them. All day. Every day.

We are talking billions and billions of transactions here. Many of these trades are made in a handful of thousandths of a second.

Nanex watches these transactions as they happen and stores up all of this information. Which means that these guys have a lot of data on their hands. Actually, according to Eric, Nanex's database is now more than 20 times the size of NASA's. That's right -- we've got more data on the stocks than we do on space.

Which you might argue is silly (and I might agree), but I think it's good for at least two reasons:

1. When something like the Flash Crash happens, Nanex can look back at all their data and give us a millisecond-by-millisecond, slow-motion playback of the whole thing.

2. You get some damn good looking graphs.

I mean, just look at that thing! And this next one is super hot (as in: it is pretty & it looks like fire):

All of these charts (as well as hundreds more) show Nanex's attempt to take a peek at speeds that no human will ever experience.

But there's more.

Eric wants to not only see the speed of these trades, he wants to hear them too. Now, when it comes to hearing the speed of these trades, Eric has done something truly marvelous.

First, he isolated just one stock in the market. Then, he assigned a musical note on an electric keyboard to strike each time there was a buy or sell order on that stock. And now? We can HEAR high frequency trades!

The pitch is determined by the price of the order; higher pitch = higher price. And for those of use whose ears don't work that fast -- here's that same stock, slowed down for our own amusement.

When we talked with Eric, he said, “I don’t expect to win a Grammy,” but he thinks he might just be able to get people a little closer to understanding the inhuman speed of these new rulers of the stock market, for better or for worse.